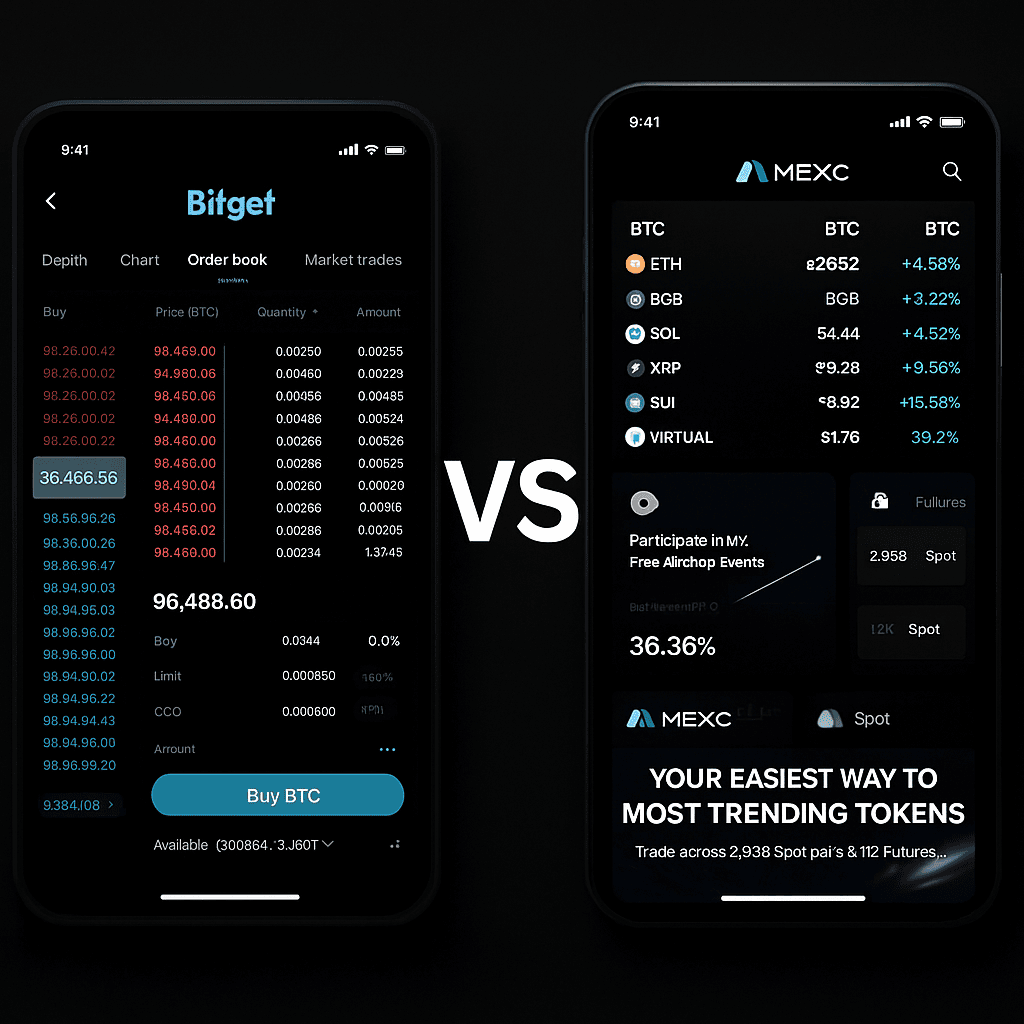

Choosing the right crypto futures exchange can make or break your trading success in 2025. Two platforms that stand out in the Email Only Signup trading space are Bitget and MEXC — both offering a rich mix of spot trading, futures contracts, altcoin access, and mobile-friendly platforms.

But when it comes to Bitget vs MEXC, which one truly delivers the better experience for futures traders, altcoin hunters, and privacy-focused users?

In this guide, we’ll break down everything you need to know: account setup, trading fees, supported coins, mobile apps, security, and more.

And if you’re ready to jump right in:

Let’s dive into the full Bitget vs MEXC comparison and see which platform is truly best for your trading goals.

Account Setup and documents required Policies: Bitget vs MEXC

When comparing Bitget vs MEXC, one of the first things traders care about is how easy it is to open an account and start trading — especially without lengthy documents required (Know Your Customer) processes.

Bitget Account Setup

Bitget offers a fast onboarding process with minimal friction:

- Email registration required (no phone or ID upload needed for basic use)

- Email Only Signup necessary for spot trading, futures trading, and withdrawals below certain thresholds

- Optional documents required for increased withdrawal limits and additional account recovery options

Sign-up usually takes under 2 minutes, and you can start trading futures contracts or spot assets immediately.

- Security features available:

- 2FA (Two-Factor Authentication)

- Anti-phishing codes

- Withdrawal whitelist options

MEXC Account Setup

MEXC is equally beginner-friendly:

- Email registration or social logins (Google, Apple) supported

- No mandatory documents required for spot or futures trading

- Verification optional unless large withdrawals or specific jurisdictions apply

Registration is instant, and funding your wallet for trading takes just a few clicks.

- Security features include:

- 2FA setup (SMS or Google Authenticator)

- Withdrawal protection mechanisms

Verdict on Account Setup

In the battle of Bitget vs MEXC for account creation and documents required policies, it’s nearly a tie. Both platforms prioritize privacy, speed, and ease of use, making them perfect choices for traders who want to skip bureaucracy and start trading right away.

Next, let’s break down the spot trading experience on each platform and see who offers the better deal for altcoin traders.

Spot Trading Options and Fees: Bitget vs MEXC

For traders who actively buy and sell altcoins, the spot trading experience matters just as much as leverage and tools. When comparing Bitget vs MEXC, both exchanges offer deep liquidity and a wide range of trading pairs — but there are some key differences worth noting.

Bitget Spot Trading

Bitget supports over 450 spot trading pairs, including major coins like BTC, ETH, and stablecoins (USDT, USDC), as well as a growing range of altcoins.

- Maker Fee: 0.1%

- Taker Fee: 0.1%

- Staking and launchpad features are integrated for spot holders

- Clean UI with TradingView charts and instant order placement

Bitget also allows for grid trading bots on spot markets, giving passive traders a way to automate altcoin accumulation or arbitrage-style moves.

MEXC Spot Trading

MEXC offers a slightly broader range of assets — over 1,500 coins and tokens — making it one of the best exchanges for discovering low-cap and trending projects.

- Maker Fee: 0% ✅

- Taker Fee: 0.1%

- Regular “M-Day” promotions and listings of emerging tokens

- Launchpad events often drive liquidity into spot markets

MEXC is known for listing altcoins faster than most major exchanges, which makes it a favorite for early adopters and altcoin scalpers.

Verdict: Who Wins on Spot?

If you’re focused on altcoin variety and 0% maker fees, MEXC takes the edge. For traders who value trading bots and advanced spot tools, Bitget still holds strong.

Coming up next: We’ll look at how each platform handles futures trading — and which one gives you better leverage, features, and execution.

Futures Trading Experience: Bitget vs MEXC

If you’re serious about leveraging crypto for bigger moves — futures trading is where the action happens. Comparing Bitget vs MEXC in this category reveals some important differences in leverage options, interface design, and advanced trading tools.

Bitget Futures Trading

Bitget has rapidly built a reputation as one of the top crypto futures exchanges globally, thanks to:

- Up to 125x leverage available on major pairs like BTC/USDT

- USDT-margined, USDC-margined, and coin-margined contracts

- Over 250+ futures pairs, including many altcoins

- Copy trading features where you can follow top-performing traders

- Deep liquidity and low slippage on major contracts

- TradingView chart integration for all contracts

Bitget’s futures dashboard is built for speed and precision — ideal for both scalpers and swing traders.

MEXC Futures Trading

MEXC also offers a robust futures platform, but with a slightly different focus:

- Up to 200x leverage offered on select pairs (higher than Bitget)

- Wide selection of USDT-margined and coin-margined perpetuals

- Deep altcoin futures market — more obscure tokens available than most exchanges

- Fast order execution and advanced risk management settings

- Regular zero-fee promotions on futures trading events

One of MEXC’s biggest strengths is the sheer breadth of futures markets — you can trade niche altcoins that aren’t even listed on Binance futures.

Verdict: Who Wins on Futures?

- Bitget wins for traditional futures traders who prioritize liquidity, deep BTC/ETH books, and professional-level tools like copy trading.

- MEXC wins for altcoin futures hunters who want to experiment with high-risk, high-reward pairs across hundreds of tokens.

In the next section, we’ll break down the fee structures between Bitget and MEXC — so you know exactly where your trading profits can stretch further.

Fee Structures Compared: Bitget vs MEXC

When evaluating Bitget vs MEXC, trading fees are a major consideration — especially for high-frequency futures traders and active spot market players. Lower fees directly translate into higher net profits.

Let’s take a closer look at how Bitget and MEXC compare across deposits, spot trading, futures trading, and withdrawals.

Bitget Fee Structure

| Fee Type | Bitget Rates |

|---|---|

| Spot Maker Fee | 0.1% |

| Spot Taker Fee | 0.1% |

| Futures Maker Fee | 0.02% |

| Futures Taker Fee | 0.06% |

| Deposit Fee | Free (crypto deposits only) |

| Withdrawal Fee | Variable (e.g., 1 USDT on TRC20) |

Bitget offers reasonable fees, and users who hold BGB (Bitget Token) can sometimes get trading fee discounts.

MEXC Fee Structure

| Fee Type | MEXC Rates |

|---|---|

| Spot Maker Fee | 0% ✅ |

| Spot Taker Fee | 0.1% |

| Futures Maker Fee | 0.00%–0.02% (varies by pair) |

| Futures Taker Fee | 0.03%–0.05% (varies by pair) |

| Deposit Fee | Free (crypto deposits only) |

| Withdrawal Fee | Variable (competitive with industry standards) |

MEXC aggressively promotes 0% spot trading fees and often hosts promotional zero-fee events on futures pairs too.

Fee Comparison Verdict

- MEXC wins on spot trading thanks to 0% maker fees.

- Bitget and MEXC are very close on futures fees, depending on trading volume and pair selection.

- Both offer strong value — making fee-conscious trading viable on either platform.

Coming up next: we’ll dive into how each exchange’s mobile app and user experience stack up — crucial for traders who trade on the go.

Mobile App and User Experience: Bitget vs MEXC

In 2025, mobile-first trading is more important than ever. A clean, fast, and reliable mobile app can make a huge difference in execution speed, security, and overall trading satisfaction. Comparing Bitget vs MEXC, both exchanges invest heavily in mobile optimization — but there are differences traders should know.

Bitget Mobile App

| Feature | Bitget App Details |

|---|---|

| Platforms | iOS, Android |

| Interface | Professional trading dashboard, dark/light mode support |

| Features | Spot trading, futures trading, copy trading, staking |

| Charts | Integrated TradingView charts for technical analysis |

| Speed | Very fast load times, real-time order book updates |

| Security | 2FA, device management, withdrawal whitelist |

Bitget’s app feels built for serious traders — offering a full desktop-grade experience on mobile without sacrificing speed.

MEXC Mobile App

| Feature | MEXC App Details |

|---|---|

| Platforms | iOS, Android |

| Interface | Clean, beginner-friendly design |

| Features | Spot trading, futures trading, staking, launchpad access |

| Charts | Custom MEXC charts with indicator support |

| Speed | Fast execution, minimal lag even under high traffic |

| Security | 2FA, withdrawal authentication, biometric login |

MEXC’s app leans more toward accessibility — making it ideal for newer traders who prioritize ease of use.

Verdict on Mobile UX

- Bitget wins for traders who want a pro-level mobile terminal.

- MEXC wins for users who prefer a smoother, beginner-optimized app.

In the next section, we’ll compare safety, regulation, and trustworthiness between these two exchanges to help you pick the one you can rely on most.

Safety, Regulation, and Trustworthiness: Bitget vs MEXC

Before committing funds to any exchange, smart traders ask a key question: how safe is this platform? In the matchup of Bitget vs MEXC, both exchanges maintain solid reputations and take meaningful steps to protect users.

Bitget: Security and Compliance

| Factor | Details |

|---|---|

| HQ | Seychelles / Singapore operations |

| Regulatory Status | Registered MSB in multiple regions |

| Fund Safety | Protection Fund (Bitget Protection Fund valued at ~$300M) |

| Incident History | No major breaches reported |

| User Security | 2FA, withdrawal whitelist, device tracking |

Bitget’s protection fund and public insurance strategy have become one of its standout trust signals — especially for high-volume traders.

MEXC: Security and Oversight

| Factor | Details |

|---|---|

| HQ | Seychelles-based |

| Regulatory Status | Offshore but compliant with general AML policies |

| Fund Safety | No public insurance fund, but strong wallet controls |

| Incident History | No major hacks reported to date |

| User Security | 2FA, anti-phishing code, biometrics for mobile app |

MEXC maintains robust internal wallet separation and has built a reputation among privacy-focused users for reliability.

Verdict on Trust and Safety

- Bitget wins for larger traders who want peace of mind through fund protection and visible safeguards.

- MEXC holds its own, especially for users who prioritize privacy, minimal documents required, and fast mobile access.

In the next section, we’ll summarize everything with a quick side-by-side pros and cons breakdown to help you choose the best exchange based on your personal trading style.

Pros and Cons Summary: Bitget vs MEXC

When deciding between Bitget vs MEXC, it often comes down to your trading style, preferred coins, and what features you value most. Here’s a quick breakdown to make your decision easier.

Bitget Pros and Cons

| Pros | Cons |

|---|---|

| Up to 125x leverage on major pairs | Smaller altcoin selection compared to MEXC |

| Deep liquidity for futures trading | documents required required for high withdrawal limits |

| Copy trading features | Spot fees (0.1%) not as low as competitors |

| Bitget Protection Fund for user safety | Limited fiat on-ramp options |

| Advanced mobile app experience |

MEXC Pros and Cons

| Pros | Cons |

|---|---|

| 0% spot maker fees | Lighter regulation compared to Bitget |

| Over 1,500 coins listed | Higher volatility on obscure altcoin pairs |

| Up to 200x leverage available | No public protection fund |

| Strong mobile app for beginners | Interface less customizable for advanced users |

| Fast new coin listings |

Quick Takeaway

- Choose Bitget if you prioritize security, liquidity, and pro-grade trading tools.

- Choose MEXC if you value a wide range of altcoins, 0% spot fees, and flexibility with no verification needed.

Coming up next: we’ll close out this head-to-head comparison with a final verdict — plus your best next steps based on your trading goals.

Final Verdict: Bitget vs MEXC — Which Exchange Should You Choose?

After a deep head-to-head comparison of Bitget vs MEXC, the choice really comes down to your trading priorities.

- Choose Bitget if you’re focused on futures trading with deep liquidity, professional tools like copy trading, and added peace of mind through security features like the Bitget Protection Fund.

- Choose MEXC if you want access to a broader selection of altcoins, 0% spot trading fees, and an ultra-fast, beginner-friendly mobile app for trading on the go.

Both platforms excel in privacy-first onboarding, fast registration, and strong user experiences. There’s no wrong answer — only the exchange that best matches your trading style.

Ready to get started?

- Sign up for Bitget here and experience top-tier futures trading with professional-grade tools.

- Open your free MEXC account here and dive into thousands of altcoins with Email Only Signup.

Want even more options? Explore our full guide to the Best Crypto Futures Exchanges in 2025 and discover even more Email Only Signup platforms perfect for traders like you.

CryptoPulseHQ is a crypto-focused publication built by professional traders, for traders. With over 7 years of experience in the crypto space, our mission is to simplify exchanges, tools, and strategy — so you can trade smarter and stay one step ahead.

We publish daily guides, comparison blogs, and step-by-step tutorials to help you navigate the fast-moving world of crypto with clarity and confidence.

This guide was written by a cryptocurrency researcher with extensive experience in altcoin platforms, decentralized trading tools, and global exchange analysis. Our goal is to help users trade securely and responsibly through transparent education. — **Disclaimer:** This content is for informational purposes only and does not constitute financial, investment, or legal advice. Always review the laws in your country before using any cryptocurrency platform. Trading involves risk, and past performance is not a guarantee of future results. Some of the links on this site are affiliate links, which means we may earn a commission if you click through and make a purchase — at no additional cost to you.