Copy trading sounds like a dream come true—just choose a successful trader, copy their moves, and watch your portfolio grow. At least, that’s the promise. But how does it actually work on Bitunix? And more importantly, is it safe?

In 2025, more beginners and passive investors are exploring Bitunix’s copy trading feature, hoping to ride the coattails of professional traders. But Reddit threads and Telegram chats are flooded with mixed experiences—some praising it, others warning of huge losses.

This guide is written to give you the real story. We’ll break down exactly how Bitunix copy trading works, who it’s for, the red flags to avoid, and whether it’s actually a smart way to trade. You’ll also hear directly from our lead crypto strategist, Lucas Tran, who tested Bitunix copy trading firsthand.

Before we get into the how, if you’re unfamiliar with Bitunix itself, check out our full Bitunix review to get context on the platform’s features and trading tools.

Let’s demystify copy trading—without the hype.

What Is Copy Trading on Bitunix?

Bitunix copy trading lets you automatically replicate the trades of more experienced traders, known on the platform as “signal providers.” Once connected, every move they make—whether it’s a long on BTC or a short on an altcoin—is mirrored in your account in real time.

It works like this:

- You choose a trader from the copy trading marketplace.

- You allocate a portion of your funds to follow them.

- Their trades are synced to your account using Bitunix’s backend automation.

- You can pause, stop, or adjust your copy anytime.

This system is designed for traders who want exposure to the markets without having to research charts or build strategies. It’s especially popular among beginners who feel overwhelmed by technical analysis.

Each signal trader on Bitunix comes with a public profile showing:

- ROI (return on investment)

- Win/loss ratio

- Number of followers

- Average leverage used

- Maximum drawdown

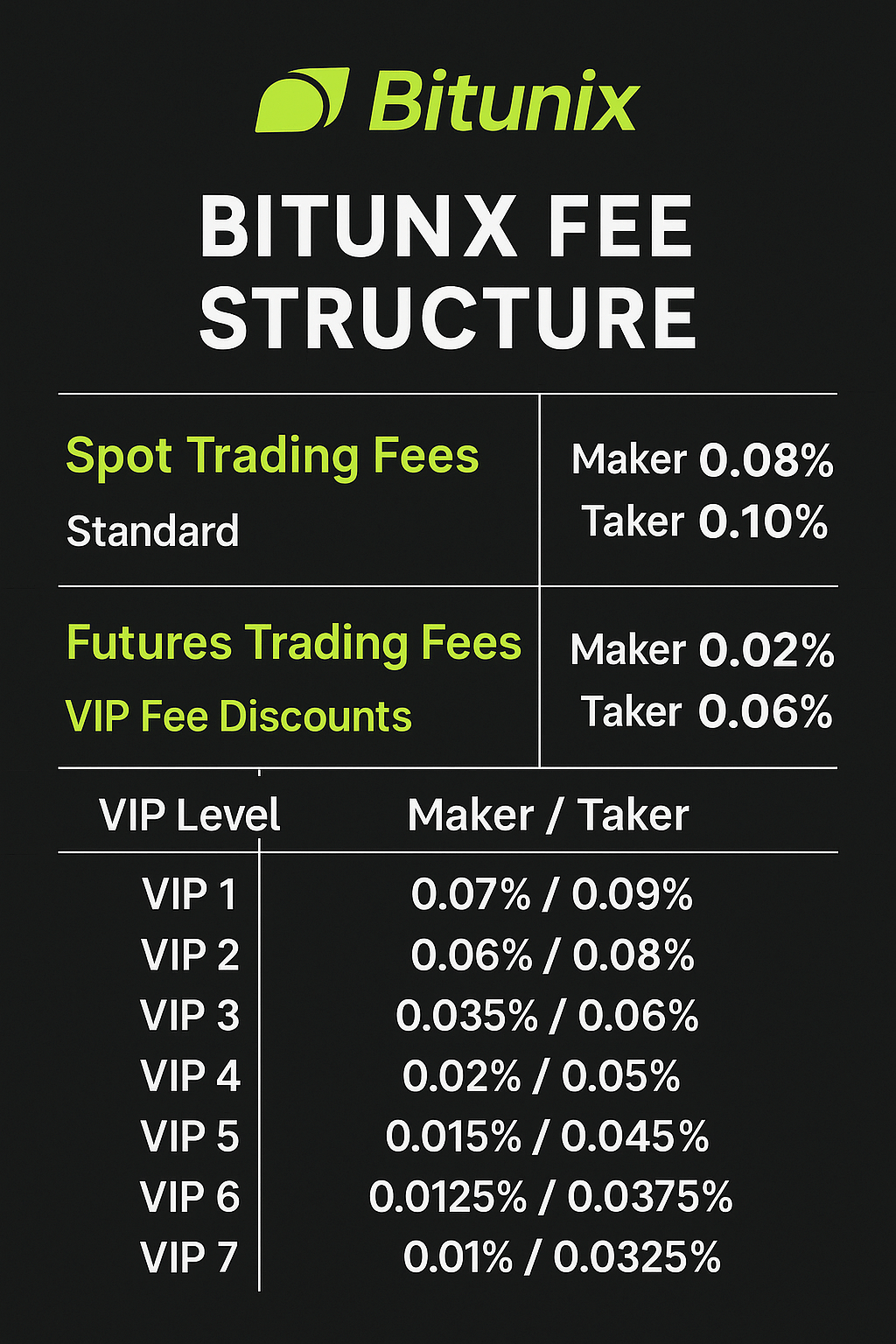

Bitunix doesn’t charge extra to copy—signal traders take a profit share (usually 10–15%) of the gains they help generate.

If you’ve never placed a manual trade before, review our Bitunix trading tutorial to understand how the platform works before jumping into automation.

Who Should Consider Bitunix Copy Trading?

Bitunix copy trading is designed for traders who want exposure to crypto markets without having to actively manage their positions. It’s best suited for:

- Complete beginners who want to learn by watching experts

- Busy investors who can’t monitor charts all day

- Part-time traders looking to test different strategies passively

- Users without a trading system who want to stay in the market without stress

That said, copy trading isn’t a free lunch. You’re still exposed to market risk, and choosing the wrong trader can result in fast losses. But for those looking to learn while earning—or delegate while staying engaged—it can be a useful middle ground.

Copy trading can act as a stepping stone: a way to get familiar with live positions and real results before developing your own strategy.

For full details on how Bitunix ranks and displays its signal traders, check out their copy trading support documentation.

The Hidden Risks Nobody Talks About

Copy trading isn’t a guaranteed path to profits. While it can be a useful tool, it comes with risks that many new users don’t fully understand.

1. Overleveraged Traders

Some signal providers use aggressive leverage to inflate short-term gains. This looks good on the surface but increases the odds of liquidation or major drawdowns during volatility.

2. Poor Risk Management

Just because a trader has a high win rate doesn’t mean they manage losses well. One bad trade can wipe out a month’s worth of gains.

3. Performance Manipulation

Some traders trade in low-volume markets where their activity artificially boosts returns. Bitunix shows ROI, but it’s your job to evaluate the full picture.

4. Slippage and Execution Delay

Your copy might lag the original trade by seconds—or longer—especially in volatile conditions. This can turn winning setups into losses.

Copy trading is a tool—not a shortcut. Understanding these risks upfront is what separates hopeful beginners from smart crypto users.

How to Choose a Good Copy Trader

Choosing the right signal provider on Bitunix is the difference between compounding gains and silently draining your capital. Here’s what to look for—and what to avoid:

✅ Look for:

- Consistent ROI over time (avoid one-hit wonders)

- Low maximum drawdown (means they manage risk)

- Moderate trade frequency (not overtrading)

- Transparency about strategy

- Leverage use under control (3x–5x max is a good benchmark)

🚫 Avoid:

- Traders with sudden spikes in ROI

- Hidden or private trade histories

- Accounts that only win during bull markets

- Signal providers with high fees and little data

Bitunix gives you access to most of these stats up front. But it’s still on you to study the chart and track record before committing funds.

A little due diligence goes a long way—especially when your capital is riding on someone else’s trades.

Expert Insight: Should You Copy or Trade Manually?

By Lucas Tran – Lead Crypto Strategist, CryptoPulseHQ

As someone who has both traded manually and tested dozens of copy trading platforms, I believe copy trading has a very specific place in a trader’s journey—but it’s not a shortcut to success.

If you’re brand new to crypto, Bitunix copy trading can be a great way to observe professional strategies in action. You’ll see how experienced traders manage entries, exits, and risk over time. But don’t mistake copying for learning.

Eventually, you’ll want to develop your own trading edge—and that requires hands-on experience. I personally recommend using Bitunix copy trading as a learning phase, not a permanent solution. Start small, monitor outcomes, and gradually experiment with your own trades as your confidence grows.

Copy trading is like training wheels. Use it to stay in the market, but don’t rely on it forever. The best traders don’t follow—they lead.

My Honest Experience with Bitunix Copy Trading

When I first tested Bitunix copy trading, I expected easy gains. I picked a top-performing trader, allocated funds, and waited for profits to roll in. For the first few days, things looked good—until that trader opened a 10x leveraged position on a small-cap altcoin and got liquidated within hours.

It was a needed wake-up call.

The platform worked exactly as promised. The issue wasn’t Bitunix—it was my lack of due diligence. I hadn’t checked the trader’s drawdown history or risk profile. I let performance numbers lure me into a false sense of security.

After that loss, I slowed down. I analyzed signal providers the way I would a project I’d invest in—looking at long-term consistency, risk ratios, and trade volume. Since then, my results have stabilized. Not every trade wins, but the strategy now fits my goals.

Copy trading isn’t set-it-and-forget-it. But with the right mindset, it can help you learn, earn, and eventually trade with more clarity.

Final Verdict: Is Bitunix Copy Trading Worth It?

Bitunix copy trading isn’t a magic money machine—but it can be a smart tool when used with clear expectations. It offers a way to stay engaged with the market, learn from more experienced traders, and potentially grow your portfolio without managing every entry and exit yourself.

Just don’t treat it as a passive income hack. Real trading involves risk, even when someone else is calling the shots. Your success still depends on doing your homework, understanding the risk profile of your chosen signal provider, and knowing when to cut ties.

If you’re using copy trading as a learning tool or stepping stone, Bitunix offers one of the more user-friendly and transparent options available today.

💡 If you’re ready to explore Bitunix copy trading, open a free account here and start small while you build trust and experience.

Want to see how Bitunix compares to other top exchanges? Read our Weex vs Bitunix breakdown next.

Frequently Asked Questions: Bitunix Copy Trading

What is Bitunix copy trading?

Bitunix copy trading allows users to automatically replicate the trades of professional or experienced traders on the platform. When the trader (signal provider) places a trade, it is mirrored in your account proportionally.

Is Bitunix copy trading safe?

It’s as safe as the trader you choose to follow. While Bitunix provides the infrastructure, your performance depends on the risk level and strategy of the signal provider. Always research their stats before allocating funds.

Do I need KYC to use copy trading on Bitunix?

No. You can start copy trading Email Only as long as your daily withdrawals stay under $10,000. Optional KYC increases your withdrawal limits.

Can I lose money with Bitunix copy trading?

Yes. Copy trading involves real market exposure. If the trader you follow loses money, so will you. It’s important to treat it like real trading—not passive income.

How do I choose the best signal trader?

Look for consistent ROI, low drawdown, clear trade history, and moderate leverage. Avoid traders with sudden spikes or no transparency.

Is copy trading better than manual trading?

Not necessarily. Copy trading is great for beginners or busy traders. But as your skills grow, manual trading gives you more control and flexibility over your strategy.

CryptoPulseHQ is a crypto-focused publication built by professional traders, for traders. With over 7 years of experience in the crypto space, our mission is to simplify exchanges, tools, and strategy — so you can trade smarter and stay one step ahead.

We publish daily guides, comparison blogs, and step-by-step tutorials to help you navigate the fast-moving world of crypto with clarity and confidence.

This guide was written by a cryptocurrency researcher with extensive experience in altcoin platforms, decentralized trading tools, and global exchange analysis. Our goal is to help users trade securely and responsibly through transparent education. — **Disclaimer:** This content is for informational purposes only and does not constitute financial, investment, or legal advice. Always review the laws in your country before using any cryptocurrency platform. Trading involves risk, and past performance is not a guarantee of future results. Some of the links on this site are affiliate links, which means we may earn a commission if you click through and make a purchase — at no additional cost to you.