Bitunix is quickly earning a reputation as one of the most cost-efficient crypto exchanges on the market—but how do its fees really stack up? If you’ve ever been blindsided by high trading costs or withdrawal surprises, this guide breaks down exactly what you’ll pay on Bitunix—and how to pay less.

Backed by real data from Bitunix’s official help center, this breakdown helps you trade smarter, not harder.

What Are Bitunix Fees?

Fees are an unavoidable part of crypto trading—but on Bitunix, they’re structured to stay transparent and competitive. Traders are primarily charged for:

- Spot trading (buy/sell assets instantly)

- Futures trading (contracts to speculate on price movement)

- Withdrawals (transferring crypto off the platform)

And here’s where Bitunix shines: it offers a clear VIP fee system that reduces costs as your trading volume increases.

For an overview of Bitunix’s trading environment, check out our Bitunix review.

Spot Trading Fees Breakdown

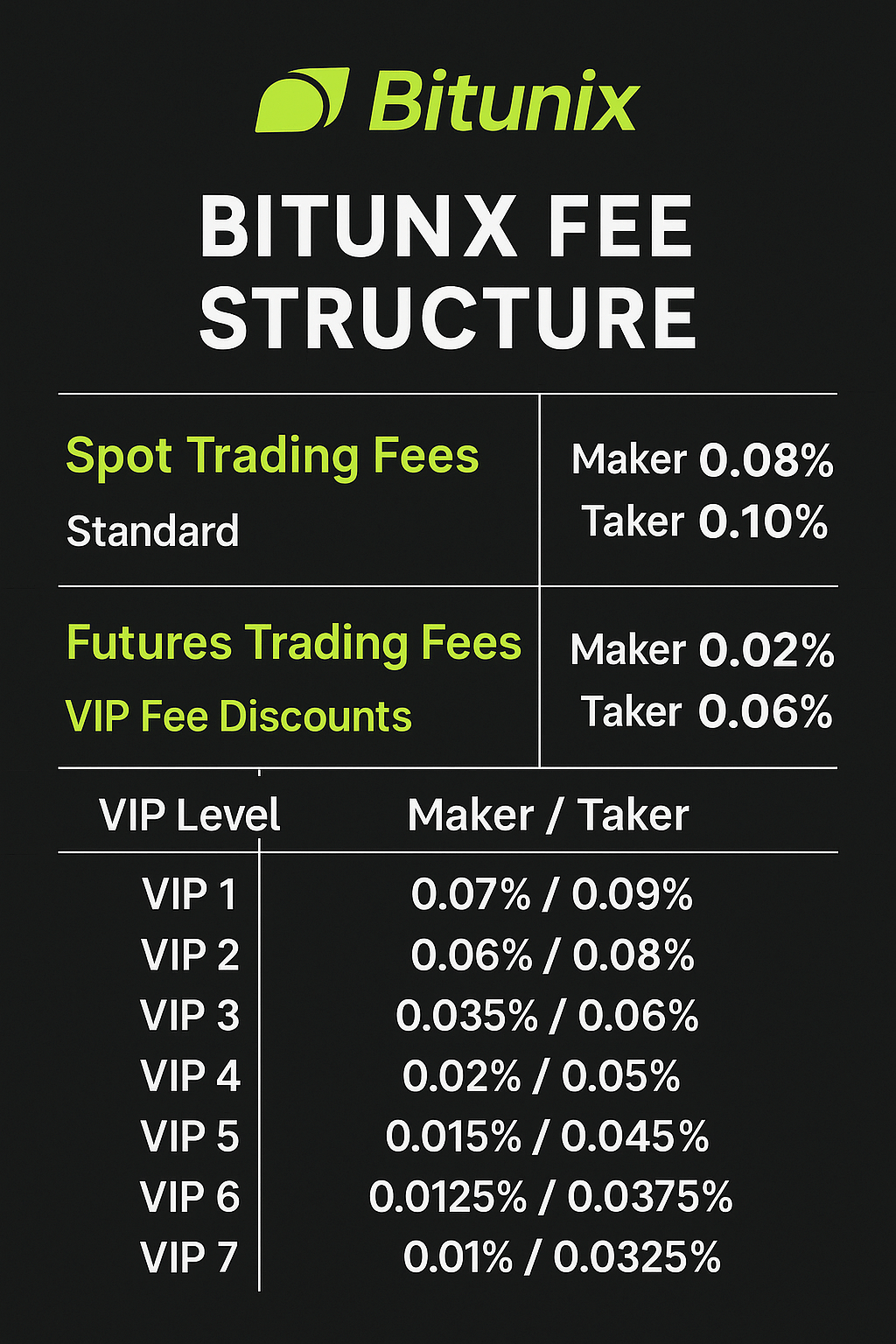

Bitunix fees for spot trading are already competitive, even before VIP discounts kick in. At the base level:

- Maker fee: 0.08%

- Taker fee: 0.10%

As your 30-day trading volume or wallet balance increases, you’ll qualify for lower fees through the VIP program. Here’s how the spot fee tiers are structured:

| VIP Level | Maker Fee | Taker Fee |

|---|---|---|

| VIP 1 | 0.07% | 0.09% |

| VIP 2 | 0.06% | 0.08% |

| VIP 3 | 0.035% | 0.06% |

| VIP 4 | 0.02% | 0.05% |

| VIP 5 | 0.015% | 0.045% |

| VIP 6 | 0.0125% | 0.0375% |

| VIP 7 | 0.01% | 0.0325% |

This tiered system is one of the reasons traders researching Bitunix fees often find it attractive—especially those executing high-frequency or large-volume trades.

Futures Trading Fees Breakdown

When it comes to futures contracts, Bitunix fees are among the most competitive in the industry. The baseline rates are already low:

- Maker fee: 0.02%

- Taker fee: 0.06%

But for active futures traders, the real value is unlocked through the VIP discount system. Below is a detailed breakdown of the fee reductions:

| VIP Level | Maker Fee | Taker Fee |

|---|---|---|

| VIP 1 | 0.02% | 0.05% |

| VIP 2 | 0.016% | 0.05% |

| VIP 3 | 0.014% | 0.04% |

| VIP 4 | 0.012% | 0.0375% |

| VIP 5 | 0.01% | 0.035% |

| VIP 6 | 0.008% | 0.0315% |

| VIP 7 | 0.006% | 0.03% |

These competitive rates make Bitunix an appealing platform for day traders and futures scalpers looking to minimize overhead.

To learn more about futures trading execution, see our Bitunix Trading Tutorial.

Withdrawal Fees and Limits

In addition to trading fees, Bitunix charges a flat fee for crypto withdrawals. These fees vary depending on the asset and blockchain network, reflecting actual on-chain costs. Here are some common examples:

- BTC: 0.0005 BTC

- ETH: 0.005 ETH

- USDT (ERC20): 10 USDT

While Bitunix does not charge deposit fees, withdrawal fees should be factored into your total cost of trading—especially for frequent movers of funds.

Withdrawal limits also depend on your account verification status:

- Email Only: Daily limit of $10,000 USD equivalent

- With KYC: Increased limits based on tier

According to Bitunix support, the platform enforces these limits to ensure platform security and regulatory compliance. If you plan to withdraw large amounts regularly, completing identity verification may be worth the added flexibility.

For the full list of supported assets and withdrawal fees, visit the Bitunix Help Center.

Bitunix VIP Discounts: How to Qualify and Why It Matters

For serious traders, high fees can quietly eat into profits. Bitunix solves this with a clear, performance-based VIP program that rewards volume and loyalty. The more you trade—or the higher your USDT balance—the less you pay.

How to Unlock VIP Tiers on Bitunix

You can qualify for VIP status in three different ways:

- Spot trading volume over the past 30 days

- Futures trading volume over the past 30 days

- Wallet balance in USDT equivalent

Here’s what it takes to reach VIP 1:

- Spot volume: $100,000+

- Futures volume: $1,000,000+

- Or balance: $1,000+ USDT

Each higher tier requires a proportional increase in activity or balance. As you move up, fees shrink—sometimes by more than 50% from the baseline.

Why VIP Status Is More Than Just Cheaper Fees

While lower maker and taker rates are the main attraction, there are additional benefits:

- Faster support response times

- Higher withdrawal limits

- Exclusive trading features (coming soon)

This system isn’t just for whales. Even mid-level traders can reach the first few VIP tiers, unlocking real savings month over month.

If you’re curious how Bitunix compares to platforms like Binance or Bitget, check out our Bitunix vs Blofin comparison for insights on overall performance and user benefits.

In short, the Bitunix VIP program is designed for one thing: rewarding your activity with meaningful, compounding savings.

Bitunix vs Other Exchanges: Fee Comparison Table

To understand how Bitunix fees measure up, it’s essential to benchmark them against other top-tier platforms. Below is a side-by-side comparison of spot and futures trading fees across popular exchanges:

| Exchange | Spot Maker | Spot Taker | Futures Maker | Futures Taker |

|---|---|---|---|---|

| Bitunix | 0.08% | 0.10% | 0.02% | 0.06% |

| Binance | 0.10% | 0.10% | 0.02% | 0.04% |

| Bitget | 0.10% | 0.10% | 0.02% | 0.06% |

| MEXC | 0.00% | 0.20% | 0.00% | 0.03% |

What This Means for Traders

Bitunix lands in a favorable position—especially for futures traders and high-frequency users who want predictable, non-inflated fees. While platforms like MEXC offer zero maker fees, their taker rates can erode profits quickly.

Bitunix strikes a balanced approach: low enough to compete with giants like Binance, but without requiring deep liquidity pools or confusing rebate systems. It also offers clarity—no bait-and-switch promotions or confusing native token burn models.

If your strategy involves active trading, Bitunix fees may provide long-term savings without sacrificing speed or support.

For a deeper look at which platform fits your needs, explore our Best Crypto Futures Trading Exchanges 2025 guide next.

Pros and Cons of Bitunix Fees

When evaluating Bitunix fees, it’s clear that the exchange is optimized for efficiency—but no platform is perfect. Here’s a balanced look at the strengths and limitations:

Pros

- Transparent pricing: All fees are publicly listed and easy to understand.

- Lower-than-average futures fees: Particularly attractive for scalpers and high-frequency traders.

- Flexible VIP system: You don’t need millions in volume to benefit from tiered discounts.

- No deposit fees: You can fund your account without incurring upfront costs.

Cons

- Withdrawal fees can vary: Depending on the chain used, some assets (like USDT ERC20) carry higher fixed fees.

- No fiat on-ramp: Users must purchase crypto elsewhere before transferring funds to Bitunix.

- Limited fee promotions: Unlike competitors who run fee holidays or token-based discounts, Bitunix keeps things steady but less promotional.

Despite a few minor drawbacks, Bitunix fees remain one of its biggest selling points—especially for traders focused on minimizing cost per trade without relying on gimmicks.

Our Expert Opinion: Are Bitunix Fees Worth It?

After reviewing dozens of exchanges and analyzing fee structures across the industry, our verdict is clear: Bitunix is a top-tier option for traders who value transparency, simplicity, and long-term savings.

Unlike some platforms that hide costs behind native token mechanics or confusing rebate systems, Bitunix offers a straight-up approach. You know your maker/taker rate. You know your withdrawal fee. And if you’re an active trader, you can easily lower those numbers by reaching VIP tiers.

While other exchanges lean heavily on promotions or short-term discounts, Bitunix appeals to seasoned traders looking for reliable pricing models. It’s a platform that respects math, not marketing.

If you’re building a sustainable strategy in crypto—especially if you trade futures or rotate between altcoin pairs—Bitunix fees will help you keep more of what you earn. For us, that makes it a strong recommendation.

For serious traders comparing platforms, we also suggest reading our Bitunix vs Weex comparison for a deeper look at trading experience and execution quality.

Final Verdict: Bitunix Fees Offer Real Long-Term Value

In a landscape crowded with flashy discounts and complex token mechanics, Bitunix stands out for its clarity and consistency. Its transparent fee structure, accessible VIP tiers, and competitive rates make it one of the strongest platforms for traders who want to grow sustainably.

Whether you’re just getting started or scaling up volume, understanding Bitunix fees gives you a serious edge. Every fraction of a percent matters—and over time, the savings add up.

If you’re ready to trade smarter and pay less, open a Bitunix account here and take advantage of their low fees and VIP discounts.

And if you’re comparing platforms, don’t miss our complete review of Bitunix and detailed Bitunix Proof of Reserves breakdown to understand why it’s quickly becoming a go-to choice for informed crypto traders.

Frequently Asked Questions: Bitunix Fees

How much are the trading fees on Bitunix?

Bitunix charges a base spot trading fee of 0.08% for makers and 0.10% for takers. Futures trading fees start even lower—0.02% for makers and 0.06% for takers. These rates can drop significantly as you move up VIP tiers.

Are there any deposit fees on Bitunix?

No, Bitunix does not charge deposit fees. You can fund your account without incurring any cost on the platform’s end.

What are the withdrawal fees on Bitunix?

Withdrawal fees vary based on the asset and blockchain network. For example, BTC withdrawals currently cost 0.0005 BTC, while USDT (ERC20) costs 10 USDT. Always check the live rates before transferring funds off the platform.

How do I qualify for lower fees on Bitunix?

You can access lower fees by qualifying for a VIP tier. This depends on your 30-day trading volume (spot or futures) or your account balance in USDT. The more you trade or hold, the better your discount.

Can I trade Email Only on Bitunix?

Yes. You can trade Email Only on Bitunix, but your withdrawal limit will be capped at $10,000 USD equivalent per day. Completing KYC increases this limit.

How does Bitunix compare to Binance or MEXC in terms of fees?

Bitunix holds its own against major platforms. While Binance may offer slightly lower futures taker fees (0.04%), Bitunix remains extremely competitive and provides transparent tier-based pricing. MEXC offers zero maker fees, but its taker fees are higher.

For more details on how Bitunix stacks up, visit our best crypto futures trading exchanges guide.

CryptoPulseHQ is a crypto-focused publication built by professional traders, for traders. With over 7 years of experience in the crypto space, our mission is to simplify exchanges, tools, and strategy — so you can trade smarter and stay one step ahead.

We publish daily guides, comparison blogs, and step-by-step tutorials to help you navigate the fast-moving world of crypto with clarity and confidence.

This guide was written by a cryptocurrency researcher with extensive experience in altcoin platforms, decentralized trading tools, and global exchange analysis. Our goal is to help users trade securely and responsibly through transparent education. — **Disclaimer:** This content is for informational purposes only and does not constitute financial, investment, or legal advice. Always review the laws in your country before using any cryptocurrency platform. Trading involves risk, and past performance is not a guarantee of future results. Some of the links on this site are affiliate links, which means we may earn a commission if you click through and make a purchase — at no additional cost to you.