Understanding contango and backwardation in crypto futures markets can unlock profitable trading opportunities that most retail traders completely miss. These market conditions reveal critical information about supply, demand, and trader sentiment that experienced traders use to time entries, predict price movements, and execute advanced strategies.

Most crypto traders focus exclusively on spot prices while ignoring the valuable signals hidden in futures curves. This oversight leaves money on the table and misses early warning signs of major market moves. Learning to identify and trade contango and backwardation conditions provides a significant edge in volatile crypto markets.

The relationship between spot prices and futures prices tells a story about market expectations, carrying costs, and the balance between bulls and bears. When you understand this relationship, you can position yourself ahead of major trends and profit from market inefficiencies that others overlook.

This comprehensive guide examines exactly how contango and backwardation work in crypto futures, how to identify these conditions, and most importantly, how to trade them profitably. Whether you’re managing a small account or sophisticated portfolio, these concepts apply across all trading strategies and timeframes.

Market Conditions Comparison: Contango vs Backwardation

| Condition | Futures Price | Spot Price | Market Sentiment | Typical Duration | Trading Opportunity |

|---|---|---|---|---|---|

| Contango | Higher | Lower | Bullish expectation | Weeks to months | Sell futures, buy spot |

| Backwardation | Lower | Higher | Bearish expectation | Days to weeks | Buy futures, sell spot |

| Normal | Slightly higher | Lower | Neutral | Ongoing | Cost of carry arbitrage |

| Severe Contango | Much higher | Much lower | Extreme bullish | Peak market periods | High-probability shorts |

| Deep Backwardation | Much lower | Much higher | Extreme bearish | Market crashes | High-probability longs |

Understanding Contango in Crypto Futures

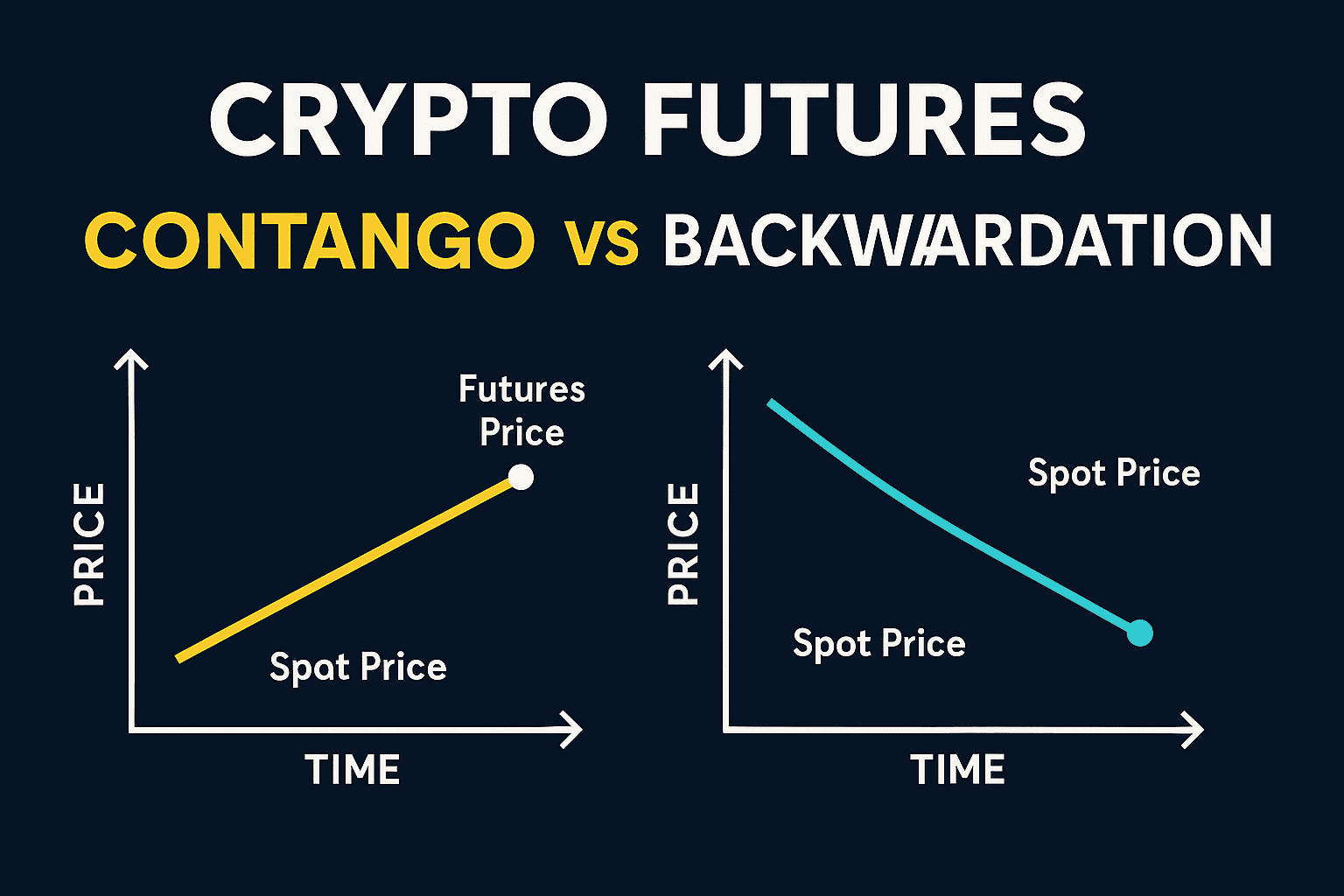

Contango occurs when futures contracts trade at higher prices than the current spot price of the underlying cryptocurrency. This condition typically reflects bullish market sentiment, where traders are willing to pay a premium for future delivery of Bitcoin, Ethereum, or other cryptocurrencies.

In traditional commodities, contango often results from storage costs, insurance, and financing charges built into futures prices. However, crypto assets have minimal storage costs, making contango primarily a reflection of market psychology and leverage demand rather than physical carrying costs.

How Contango Develops in Crypto Markets

Bitcoin futures entering contango usually signals that leveraged long positions are increasing faster than the market can absorb them. When retail and institutional traders aggressively buy futures contracts, they bid up prices beyond current spot levels, creating the premium characteristic of contango markets.

The magnitude of contango reveals the intensity of bullish sentiment. Mild contango (1-3% premium) suggests modest optimism, while extreme contango (10%+ premium) often indicates speculative excess that frequently precedes market corrections.

Ethereum futures show similar patterns but tend to experience more volatile contango periods due to network upgrade expectations, DeFi developments, and staking rewards influencing long-term price expectations.

Trading Strategies for Contango Markets

The most straightforward contango trade involves selling overpriced futures while buying the underlying spot asset. This arbitrage strategy captures the premium as futures prices converge toward spot prices approaching expiration.

Advanced traders use contango as a signal for potential market tops. When futures premiums reach extreme levels (15-20% or higher), it often indicates speculative excess that leads to sharp corrections within days or weeks.

Professional traders also monitor contango intensity across different expiration dates. If near-term contracts show higher premiums than longer-dated contracts, it suggests immediate bullish pressure that may not be sustainable, creating short-selling opportunities.

Backwardation in Crypto Futures Markets

Backwardation represents the opposite condition, where futures contracts trade below current spot prices. This unusual situation typically occurs during severe market stress when immediate demand for cryptocurrencies exceeds futures market interest.

In crypto markets, backwardation often signals capitulation by leveraged traders or urgent spot buying pressure from institutional accumulation. Unlike traditional commodities where backwardation might reflect supply shortages, crypto backwardation usually indicates extreme bearish sentiment followed by potential reversals.

Identifying Backwardation Opportunities

Backwardation in Bitcoin or Ethereum futures frequently coincides with major market bottoms. When futures trade at significant discounts to spot prices (5-10% or more), it often indicates that bearish sentiment has reached extremes.

The depth and persistence of backwardation provide clues about reversal timing. Brief backwardation (lasting hours to days) might represent temporary dislocations, while sustained backwardation (weeks) often precedes significant bull market moves.

Cross-referencing backwardation with other indicators like funding rates, open interest, and liquidation data enhances the reliability of potential reversal signals derived from futures curve analysis.

Practical Trading Applications

Successful contango and backwardation trading requires understanding multiple timeframes and market contexts. Short-term traders can exploit rapid convergence between futures and spot prices, while longer-term investors use these conditions to identify major trend changes.

Arbitrage Trading Strategies

Pure arbitrage involves simultaneously buying underpriced contracts and selling overpriced ones to capture risk-free profits. In contango markets, this means buying spot crypto and selling futures. In backwardation, the reverse trade applies.

However, crypto arbitrage carries execution risks including slippage, funding costs, and timing challenges that can erode profits if not managed carefully. Proper risk management strategies become essential when implementing these approaches across volatile crypto markets.

Directional Trading Based on Curve Shape

Experienced traders use extreme contango as a signal to reduce long positions or initiate shorts, anticipating that excessive premiums indicate unsustainable bullish sentiment. Conversely, deep backwardation often provides high-probability long entry opportunities.

The key lies in timing and position sizing. Extreme market conditions can persist longer than expected, making gradual position building more effective than attempting to time exact reversals.

Platform selection becomes crucial for executing these strategies effectively. Bitunix offers comprehensive futures trading tools with real-time curve analysis and competitive execution that serious contango and backwardation traders require for consistent profitability.

Advanced Market Analysis Techniques

Professional traders combine contango and backwardation analysis with other derivatives metrics to build comprehensive market pictures. Funding rates, options skew, and open interest data provide additional context for interpreting futures curve signals.

Cross-Asset Analysis

Comparing contango and backwardation across different cryptocurrencies reveals market-wide sentiment shifts. When Bitcoin, Ethereum, and major altcoins simultaneously show similar curve patterns, it suggests broad-based directional pressure rather than asset-specific factors.

Divergences between different cryptocurrencies’ futures curves can indicate relative strength or weakness, creating pair trading opportunities for sophisticated strategies.

Risk Management Considerations

Trading contango and backwardation involves unique risks that standard spot trading approaches don’t address. Futures curves can remain in extreme conditions longer than positions can withstand, making proper risk controls essential.

Position Sizing and Timing

Extreme contango or backwardation provides high-probability trade setups, but timing remains challenging. Using smaller initial positions with planned additions as conditions intensify helps manage timing risk while maintaining upside potential.

Stop-loss placement becomes critical since these trades often move against you initially before reversing. Setting stops based on curve normalization rather than absolute price levels provides more relevant risk management.

Platform and Execution Requirements

Successfully trading these conditions requires reliable execution and comprehensive market data. Understanding which exchanges provide the best futures trading environments helps ensure that technical analysis translates into profitable execution.

The ability to quickly switch between spot and futures markets, access real-time curve data, and execute simultaneous trades across different contract months determines trading success in these strategies.

Timing Market Reversals with Curve Analysis

Historical analysis shows that extreme contango and backwardation conditions often precede significant trend changes in crypto markets. The Bitcoin bull markets of 2017 and 2021 both featured periods of extreme contango before major corrections, while backwardation appeared near cycle lows.

Historical Pattern Recognition

The 2018 Bitcoin bear market showed persistent contango through most of the decline, but backwardation appeared during final capitulation phases around $3,200. Similarly, the March 2020 COVID crash created deep backwardation that preceded one of crypto’s strongest bull runs.

Ethereum futures showed similar patterns but with more pronounced moves due to lower liquidity and higher volatility in derivatives markets compared to Bitcoin.

Combining Multiple Timeframes

Analyzing contango and backwardation across different expiration dates provides additional insight into market timing. When both near-term and longer-dated contracts show extreme conditions, it suggests more significant directional pressure than single-month anomalies.

Term structure inversion (where longer-dated contracts show opposite conditions to near-term ones) often indicates transition periods where major trend changes are developing.

Platform-Specific Implementation

Different exchanges calculate and display futures curves with varying methodologies, making platform selection important for accurate analysis. Some exchanges provide superior charting tools and real-time curve data that enhance decision-making.

| Exchange Feature | Importance | Bitunix | Other Platforms |

|---|---|---|---|

| Real-time curve data | Critical | ✓ Advanced | Variable |

| Multiple expiration tracking | High | ✓ Comprehensive | Limited |

| Arbitrage execution tools | High | ✓ Integrated | Separate |

| Low latency execution | Critical | ✓ Optimized | Standard |

| Risk management tools | Essential | ✓ Built-in | Basic |

Bitunix’s advanced futures trading platform provides institutional-grade tools for analyzing and trading contango and backwardation conditions, with integrated risk management and execution capabilities that retail platforms often lack.

Expert Insight from Lucas Tran

Lucas Tran, Certified Blockchain Analyst

After analyzing crypto futures curves for over seven years, I’ve observed that contango and backwardation provide some of the most reliable signals for major market transitions, but only when properly contextualized within broader market conditions.

The biggest mistake I see traders make is treating these conditions as mechanical buy or sell signals without considering duration, magnitude, and market context. I’ve successfully used extreme contango (>15% premiums) as early warning signals for market tops, but timing remains crucial. The 2021 bull market showed persistent extreme contango for weeks before the final correction, teaching me that position sizing and patience matter more than perfect entry timing.

My most profitable backwardation trades occurred during the March 2020 crash and several smaller corrections where futures traded at 8-12% discounts to spot prices. These opportunities typically last only days, requiring quick decision-making and reliable execution platforms. I’ve primarily used Bitunix for these trades because their curve analysis tools and execution speed provide significant advantages during fast-moving market conditions.

One insight that transformed my approach: correlation between funding rates and futures curves significantly improves signal reliability. When extreme contango coincides with persistently high funding rates above 0.3% daily, major corrections typically follow within 2-4 weeks. Similarly, deep backwardation combined with negative funding rates often marks excellent long-term buying opportunities.

The risk management aspect cannot be overstated. These trades can move against you for extended periods before reversing, making proper position sizing essential. I typically risk no more than 2-3% of capital per trade and use scaling entries rather than single large positions. This approach has allowed me to capture major trend changes while surviving the inevitable false signals that occur in volatile crypto markets.

Looking forward, I expect these patterns to remain relevant as crypto markets mature, but the magnitude of extremes may diminish as institutional participation increases and market efficiency improves. The key will be adapting position sizes and expectations accordingly while maintaining the core analytical framework.

Common Mistakes and How to Avoid Them

Many traders approach contango and backwardation with oversimplified strategies that ignore market context and risk management principles. Understanding common pitfalls helps develop more robust trading approaches.

Mistake 1: Mechanical Signal Following

Treating extreme contango or backwardation as automatic buy or sell signals without considering broader market conditions leads to poorly timed entries and excessive losses during extended extreme periods.

Solution: Use these conditions as directional bias indicators rather than precise timing signals. Combine curve analysis with other technical and fundamental factors for comprehensive trade decisions.

Mistake 2: Inadequate Risk Management

Assuming that “obvious” arbitrage opportunities carry minimal risk ignores execution challenges, funding costs, and the possibility of further curve extension beyond expected levels.

Solution: Apply proper position sizing, use stop-losses based on curve normalization rather than price levels, and maintain sufficient capital reserves for potential scaling into positions.

Mistake 3: Platform Limitations

Using exchanges with poor derivatives data, slow execution, or limited risk management tools significantly reduces the effectiveness of contango and backwardation strategies.

Solution: Select platforms specifically designed for sophisticated derivatives trading with comprehensive analysis tools and reliable execution capabilities.

Building a Systematic Approach

Successful contango and backwardation trading requires systematic processes rather than discretionary decision-making. Developing consistent approaches improves long-term results while reducing emotional trading mistakes.

Signal Identification Process

Establish clear criteria for identifying extreme conditions, such as contango premiums exceeding 10% or backwardation discounts beyond 5%. Document historical examples to calibrate these thresholds based on actual market behavior.

Create monitoring systems that alert you to developing extreme conditions rather than trying to constantly watch futures curves manually. Automation helps catch opportunities during off-hours when significant moves often begin.

Position Management Framework

Develop predetermined position sizing rules based on the magnitude of curve extremes. Larger dislocations justify larger positions, but always within overall risk management parameters.

Plan scaling strategies in advance, including specific criteria for adding to positions as conditions intensify or taking profits as curves normalize.

Long-Term Market Evolution

As crypto markets mature and institutional participation increases, contango and backwardation patterns may evolve. Understanding these changes helps adapt strategies to changing market conditions.

Institutional Impact

Professional market makers and arbitrage firms increasingly monitor crypto futures curves, potentially reducing the frequency and magnitude of extreme conditions. However, this also creates more subtle opportunities for traders who understand evolving patterns.

Institutional adoption of crypto derivatives may lead to more traditional futures market behavior, making analysis techniques from commodity and equity markets increasingly relevant to crypto trading.

Regulatory Considerations

Evolving regulatory frameworks around crypto derivatives may impact how exchanges structure futures contracts and calculate prices, potentially affecting contango and backwardation development.

Staying informed about regulatory changes helps anticipate shifts in market structure that could impact the effectiveness of curve-based trading strategies.

Frequently Asked Questions

What causes contango in crypto futures markets? Contango typically results from bullish sentiment where traders willingly pay premiums for future crypto delivery, combined with leverage demand exceeding available supply in derivatives markets.

How long do extreme contango or backwardation conditions usually last? Extreme conditions typically persist for days to weeks, with backwardation generally shorter-lived than contango due to the self-correcting nature of oversold markets.

Can I trade contango and backwardation with small accounts? Yes, but position sizing becomes even more critical with limited capital. Focus on the highest-probability setups and use proper risk management to preserve capital during inevitable false signals.

Which cryptocurrencies show the clearest contango and backwardation patterns? Bitcoin and Ethereum display the most reliable patterns due to higher derivatives liquidity. Smaller altcoins may show more extreme conditions but with greater execution challenges.

How do I calculate the exact contango or backwardation percentage? Subtract the spot price from the futures price, divide by the spot price, and multiply by 100. Positive results indicate contango, negative results show backwardation.

Do funding rates correlate with contango and backwardation? Yes, persistently high funding rates often accompany contango, while negative funding rates frequently coincide with backwardation, providing additional confirmation signals.

What’s the minimum premium required to consider a market in contango? While any futures premium technically represents contango, trading signals typically require premiums exceeding 5-8% to account for normal carrying costs and market noise.

How quickly can contango and backwardation conditions change? Market conditions can shift rapidly, especially during high volatility periods. Extreme contango can flip to backwardation within hours during major market moves.

Should I use stop-losses when trading these conditions? Yes, but base stops on curve normalization rather than absolute price levels. For example, exit contango trades when premiums fall below 2-3% rather than using traditional price-based stops.

Can I automate contango and backwardation trading strategies? Basic monitoring can be automated, but successful trading requires discretionary analysis of market context, making full automation challenging for most retail traders.

How do these patterns differ between regulated and unregulated exchanges? Regulated exchanges like CME often show more stable patterns due to institutional participation, while unregulated exchanges may display more extreme conditions due to retail speculation.

What’s the relationship between open interest and futures curve shape? Rising open interest during contango often indicates growing leveraged long positions, while falling open interest during backwardation may signal forced liquidations and potential reversals.

How do options markets interact with contango and backwardation? Options skew often reflects similar sentiment to futures curves, with call premiums elevated during contango and put premiums higher during backwardation periods.

Can contango and backwardation predict exact price targets? These conditions indicate directional bias rather than specific price levels, making them better suited for trend identification than precise target setting.

How important is timing when trading these conditions? Timing matters significantly since extreme conditions can persist longer than expected. Gradual position building and scaling strategies often work better than attempting to time exact reversals.

Do these patterns work across all market cap cryptocurrencies? Larger market cap cryptos with active derivatives markets show more reliable patterns, while smaller assets may display extreme conditions with insufficient liquidity for effective trading.

Should beginners attempt contango and backwardation trading? These strategies require solid understanding of derivatives markets and risk management. Beginning traders should master basic futures trading before attempting advanced curve analysis strategies.

How do macro economic events affect these patterns? Major events like regulatory announcements or institutional adoption news can rapidly shift futures curves, making fundamental analysis important alongside technical curve analysis.

What role does leverage play in creating these conditions? High leverage availability often amplifies contango during bull markets as traders bid up futures, while forced deleveraging during bear markets contributes to backwardation development.

Can I combine these strategies with other technical analysis methods? Yes, combining curve analysis with support/resistance levels, momentum indicators, and other technical tools often improves timing and reduces false signals in trading decisions.

CryptoPulseHQ is a crypto-focused publication built by professional traders, for traders. With over 7 years of experience in the crypto space, our mission is to simplify exchanges, tools, and strategy — so you can trade smarter and stay one step ahead.

We publish daily guides, comparison blogs, and step-by-step tutorials to help you navigate the fast-moving world of crypto with clarity and confidence.

This guide was written by a cryptocurrency researcher with extensive experience in altcoin platforms, decentralized trading tools, and global exchange analysis. Our goal is to help users trade securely and responsibly through transparent education. — **Disclaimer:** This content is for informational purposes only and does not constitute financial, investment, or legal advice. Always review the laws in your country before using any cryptocurrency platform. Trading involves risk, and past performance is not a guarantee of future results. Some of the links on this site are affiliate links, which means we may earn a commission if you click through and make a purchase — at no additional cost to you.