Why MEXC Futures Is Ideal for Beginners

This MEXC futures tutorial will show you how to get started even if you’ve never traded leverage before. Whether you’re just getting into altcoins or want to level up from spot trading, MEXC makes it surprisingly easy to enter the world of crypto futures.

In this step-by-step MEXC futures tutorial, we’ll walk through everything from account setup to risk management tools — designed specifically for beginners.

MEXC is one of the most beginner-friendly crypto futures exchanges available. Its clean interface, high liquidity, and access to niche altcoin pairs make it a smart choice for newer traders.

New to the platform? Read our full MEXC Review here to understand how the platform works beyond just futures.

What Makes MEXC Different from Other Futures Platforms

Before we get deeper into this MEXC futures tutorial, it’s important to understand what makes MEXC stand out from the crowd.

Unlike some exchanges that overwhelm beginners with complexity, MEXC focuses on accessibility. It supports hundreds of trading pairs — including niche altcoins — with adjustable leverage up to 200x. But more importantly, it offers clear order settings and a simplified layout that new users can navigate confidently.

MEXC also offers integrated copy trading, demo trading (paper trading), and a risk limit calculator — all built into the platform. This helps beginners learn faster while minimizing mistakes.

Unlike platforms that gate features behind advanced KYC tiers, MEXC offers most tools right after registration. That alone makes it one of the best entry-level futures platforms.

Want to see how MEXC stacks up? Check out our Crypto Futures Exchange Comparison Guide.

How to Set Up Your MEXC Futures Trading Account

This part of our MEXC futures tutorial walks you through how to go from signup to placing your first trade — even if you’re starting from zero.

- Create an account using just your email address at MEXC here.

- Once logged in, go to the top menu and select “Futures”.

- Click “Open Futures Account” — this activates your futures wallet.

- Transfer funds (usually USDT) from your Spot Wallet to your Futures Wallet.

- You’re now ready to trade!

MEXC futures also includes a demo trading mode. If you’re nervous about real money, test your strategies in the practice environment first.

You’ll be ready to place your first MEXC futures trade in under 5 minutes.

Already exploring MEXC’s altcoin features? Learn how to buy coins on MEXC before they moon.

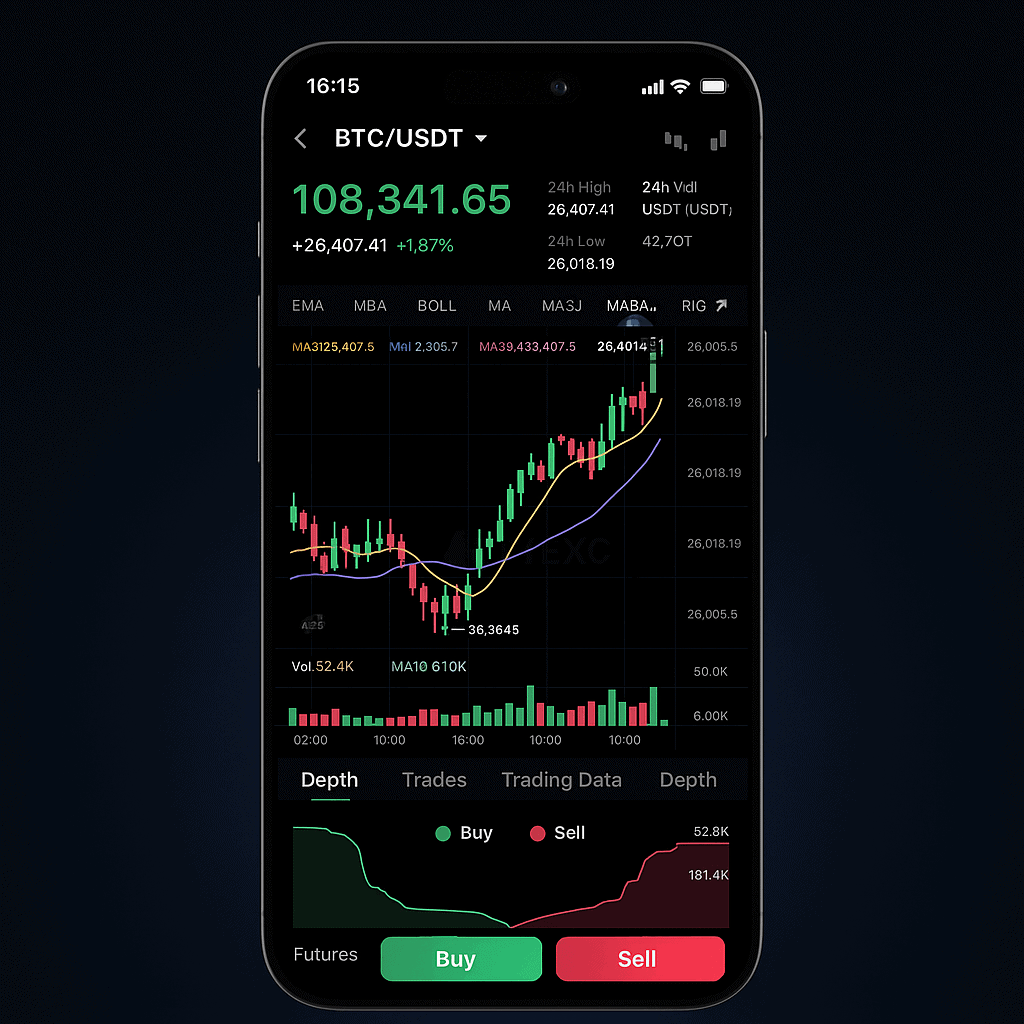

Placing Your First MEXC Futures Trade: Limit vs Market Orders

The next step in this MEXC futures tutorial is placing your first trade — and understanding how order types work.

When trading futures on MEXC, you’ll see two main order types:

- Market Order – This order executes instantly at the current market price. Great for speed, but you have less control over entry.

- Limit Order – You set the price. The order only fills if the market reaches that level, offering more precision.

To place a trade:

- Choose your trading pair (e.g., BTC/USDT or SOL/USDT).

- Select Market or Limit from the order box.

- Set your leverage using the slider (we recommend starting at 3x–5x for beginners).

- Enter your position size.

- Click “Buy/Long” or “Sell/Short” to execute.

This MEXC futures tutorial emphasizes simplicity. Once you’ve placed your first order, you’ll see your active positions and order history right below the chart.

Managing Risk: Leverage, Liquidation, and Stop Loss

This MEXC futures tutorial emphasizes one thing above all: risk management is key. Without it, even the best trading setups can go south fast.

Start with leverage. While MEXC allows up to 200x, beginners should stick to lower levels — 3x to 5x is plenty. This gives you flexibility while limiting downside exposure.

Always use a stop loss. It’s a basic but essential tool for avoiding liquidation. In MEXC, you can set a manual stop or enable a trailing stop that adjusts as your position moves in profit.

Also, understand the difference between cross and isolated margin. Cross puts your entire futures balance at risk, while isolated contains losses to a single trade. If you’re new, isolated margin should be your default.

Futures trading is high potential — but only if you learn to survive first.

Want to pair smart trading with smart altcoin entries? Explore our best MEXC Launchpad coins here.

Bonus Features: Copy Trading and Futures Bots

Beyond the basics, this MEXC futures tutorial wouldn’t be complete without covering automation and learning tools.

First, MEXC offers copy trading, which allows you to mirror the trades of experienced users. You can browse traders by PnL, win rate, or strategy type, and allocate a portion of your balance to follow them. It’s a great way for beginners to learn by watching real-time decisions.

MEXC also supports futures trading bots. These are ideal for hands-off strategies like grid trading or DCA (dollar-cost averaging) into volatility. You can customize parameters or choose from pre-set strategies based on your risk tolerance.

These tools are built into the exchange — no third-party software needed.

Want to compare MEXC’s bot features to other exchanges? Read our Best Crypto Futures Trading Exchanges Guide.

Common Mistakes New MEXC Futures Traders Make

This MEXC futures tutorial wouldn’t be complete without warning you about the traps beginners fall into — often right after opening their first trade.

Here are the most common issues:

- Skipping stop losses: Many beginners think they’ll “watch the chart,” but market volatility can wipe out positions in seconds. Always protect downside.

- Overleveraging too early: Just because 50x or 100x leverage is available doesn’t mean you should use it. Start with low leverage until you have consistent wins.

- Trading without a plan: Futures aren’t about guessing. If you don’t know your entry, target, and stop before clicking “Buy,” you’re gambling, not trading.

- FOMO during spikes: New users often jump in during pump candles, only to get caught in the immediate dump. Use limit orders and wait for clean setups.

Avoiding these errors can mean the difference between blowing up an account and building a long-term skillset.

Final Thoughts: Start Your MEXC Futures Journey with Confidence

You now have a complete MEXC futures tutorial designed specifically for beginners. From account setup to risk management, order types to automation, you’re ready to start trading with clarity and confidence.

The key is to start small, use responsible leverage, and focus on consistency — not quick wins. MEXC makes it easier than most platforms to learn futures trading without unnecessary friction.

→ Create your free MEXC account and start trading smarter

About the Author

Lucas Tran is a certified blockchain analyst and the lead researcher at CryptoPulseHQ. He specializes in altcoin strategy, decentralized exchanges, and early-stage trading platforms.

→ Read more from Lucas Tran on the CryptoPulseHQ author page

CryptoPulseHQ is a crypto-focused publication built by professional traders, for traders. With over 7 years of experience in the crypto space, our mission is to simplify exchanges, tools, and strategy — so you can trade smarter and stay one step ahead.

We publish daily guides, comparison blogs, and step-by-step tutorials to help you navigate the fast-moving world of crypto with clarity and confidence.

This guide was written by a cryptocurrency researcher with extensive experience in altcoin platforms, decentralized trading tools, and global exchange analysis. Our goal is to help users trade securely and responsibly through transparent education. — **Disclaimer:** This content is for informational purposes only and does not constitute financial, investment, or legal advice. Always review the laws in your country before using any cryptocurrency platform. Trading involves risk, and past performance is not a guarantee of future results. Some of the links on this site are affiliate links, which means we may earn a commission if you click through and make a purchase — at no additional cost to you.