Ever wondered how experienced traders seem to turn even small market moves into significant profits? The answer often lies in leverage, a powerful tool in futures trading. It presents an intriguing opportunity to amplify potential gains from relatively modest capital. However, this powerful mechanism also carries a reputation for complexity and inherent risks, intimidating many.

Beginners, in particular, often struggle to grasp how crypto futures leverage works effectively, hesitant to dive into what appears to be an expert-only domain.

But what if understanding and utilizing leverage could be clear and manageable? This guide will demystify how crypto futures leverage works, explaining its core mechanics and showing you how to apply it responsibly. We’ll explore its potential and pitfalls, and crucially, highlight how Bitunix serves as the ideal platform for a safe and streamlined experience.

Ready to learn from a top platform how to utilize leverage responsibly? Sign up for Bitunix here for a streamlined experience and confidently explore crypto futures!

Key Concepts of Futures Leverage

Understanding how crypto futures leverage works begins with a few core concepts. Here’s a quick reference:

| Term | Explanation | Example (10x Leverage) |

|---|---|---|

| Leverage | Borrowed funds to amplify position size | Control $1,000 with $100 of your own capital. |

| Margin | Your own capital used as collateral for a leveraged position. | $100 in the example above. |

| Long Position | Betting price will go up; you profit from an increase. | Buy BTC futures, profit if BTC rises. |

| Short Position | Betting price will go down; you profit from a decrease. | Sell BTC futures, profit if BTC falls. |

| Liquidation | Automatic closing of position if margin insufficient due to losses. | Your $100 collateral runs out, position closes. |

Demystifying the Mechanism: How Crypto Futures Leverage Works

At its essence, leverage in crypto futures trading allows you to control a larger financial position than the amount of capital you actually possess. It’s essentially borrowing funds from the exchange to amplify your trading power.

Let’s break down how crypto futures leverage works in practice:

- Collateral (Margin): When you open a leveraged position, you don’t put up the full value of the trade. Instead, you deposit a smaller amount, known as initial margin, which serves as collateral for the borrowed funds. This margin is your “skin in the game.”

- Leverage Ratios: Exchanges offer various leverage ratios, such as 5x, 10x, 50x, or even 125x on platforms like Bitunix. A 10x leverage ratio means for every $1 of your own capital (margin), you can control $10 worth of the asset. So, a $1,000 position would only require $100 of your own margin.

- Position Sizing: Leverage directly impacts your total position sizing. With 125x leverage, a $100 initial margin allows you to control a $12,500 position. This means your potential profits, or losses, are calculated based on the $12,500 position, not your initial $100.

- Profit & Loss Amplification: This is where the power (and risk) truly lie. If your $12,500 position gains just 1%, you’ve made $125. Compared to your initial $100 margin, that’s a 125% return. However, if the market moves 1% against you, you’ve lost $125, which is more than your initial margin.

For a deeper look at Bitunix’s overall offerings, read our comprehensive Bitunix Review.

Trading Smarter: Bitunix Simplifies How Crypto Futures Leverage Works for You

Understanding how crypto futures leverage works is one thing; applying it effectively on a trading platform is another. Bitunix excels at simplifying this process, making it an ideal environment for traders who want to utilize leverage without being overwhelmed by complexity.

Bitunix achieves this through several key features:

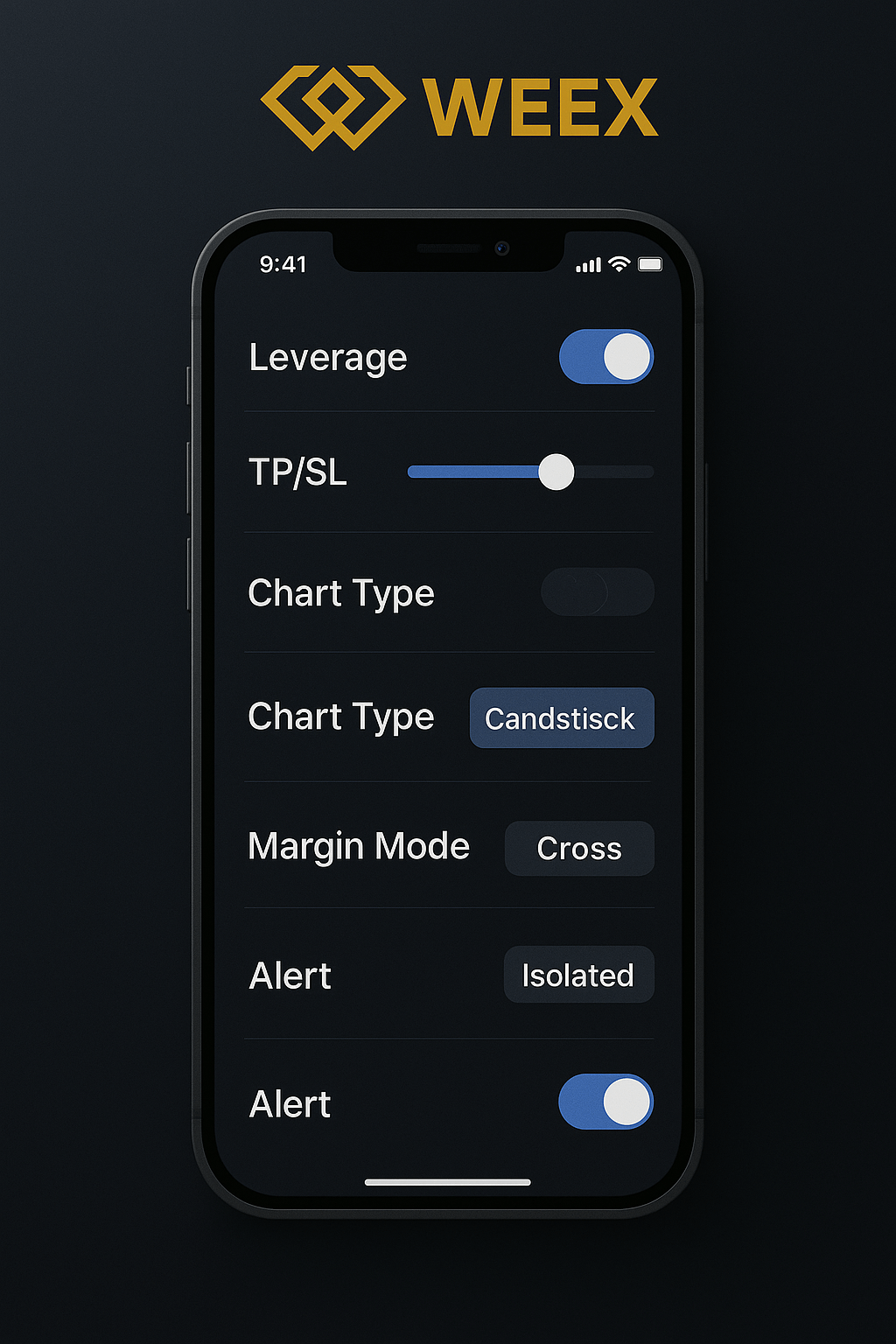

- User-Friendly Interface for Leverage Settings: Bitunix’s clean and intuitive UI makes managing your leverage ratios incredibly straightforward. When placing a trade, selecting your desired leverage is presented with clarity, using visual cues and easy-to-understand options. This reduces the confusion often associated with adjusting leverage on other platforms.

- Streamlined Onboarding: The fast and convenient sign-up process means you can get started quickly. The quick registration process allows you to gain fast access to markets with minimal initial steps, meaning you can spend less time on setup and more time learning how crypto futures leverage works in a live environment.

- Access to High Leverage: Bitunix provides options for significant amplification, offering up to 125x leverage. This allows traders to explore substantial positions with less capital, confident that the platform’s design supports informed decisions.

- Educational Support: Beyond just a clean interface, Bitunix often includes in-platform tooltips and visual guides that further explain aspects of leverage and margin, providing support as you learn.

Bitunix also stands out among the Best Crypto Exchanges in 2025.

Master Your Risk: Leveraging Bitunix’s Tools with How Crypto Futures Leverage Works

While leverage offers immense potential, neglecting its risks can be costly. Bitunix places a strong emphasis on providing essential risk management tools that empower users to trade more safely and effectively, especially when understanding how crypto futures leverage works. These features are integrated to help you navigate the amplified risks of leveraged trading positions.

Key risk management tools on Bitunix include:

- Stop-Loss Orders: These are your primary defense against significant losses. Bitunix makes it easy to set a predefined price point at which your leveraged position will automatically close if the market moves against you. This automation is absolutely vital with high leverage, as even small adverse price movements can lead to rapid capital erosion.

- Take-Profit Orders: Just as important as limiting losses is securing gains. These orders allow you to set a target price. Once reached, your position will automatically close, ensuring you capture your profits even if the futures market later reverses.

- Clear Liquidation Price Monitoring: Bitunix’s interface provides a real-time indicator of your liquidation pricedirectly on your trading screen. This constant visibility allows you to proactively monitor your risk exposure and make timely adjustments to your perpetual contracts.

- Cross Margin vs. Isolated Margin: Bitunix clearly presents the options for Cross Margin (where your entire balance acts as collateral) and Isolated Margin (where only a specific portion of your capital is allocated to a position). Understanding these allows you to control your risk exposure more precisely.

- Copy Trading: For those new to applying leverage, Bitunix’s Copy Trading feature can be invaluable. By mirroring the trades of experienced professionals, you can benefit from expert strategies that often incorporate robust risk management, providing a guided entry into amplified trading exposure.

For more comprehensive information on managing risk in leveraged trading, resources like Investopedia: What Is Leveraged Investing? offer valuable insights. Security is paramount when dealing with leverage; find out Is Bitunix Safe?

Lucas Tran’s Expert Opinion: Responsible Leverage in Crypto Futures Trading

This piece features insights from Lucas Tran, a Certified Blockchain Analyst with over 7 years of hands-on experience in crypto trading, DeFi ecosystems, and early-stage exchange platforms. As the lead researcher at CryptoPulseHQ, Lucas specializes in uncovering high-potential tools across altcoin markets, launchpads, and privacy-first trading platforms. Since entering the space in 2016, Lucas has helped thousands of readers navigate the volatile world of digital assets with clear, actionable guidance. He’s contributed to portfolio strategy workshops, trading research, and technical tutorials across multiple global platforms. At CryptoPulseHQ, his mission is simple: help everyday traders make smarter, safer, and faster decisions — even in the most unpredictable market cycles.

As someone who’s navigated the crypto markets for years, I’ve seen countless platforms. How crypto futures leverage works often carries a daunting reputation, viewed by many as a dangerous game reserved only for seasoned professionals. However, platforms like Bitunix are actively changing that narrative. What truly impresses me about Bitunix is its deliberate design to make powerful tools accessible.

They’ve not only provided access to capabilities like 125x leverage but have done so within an intuitive framework. For beginners especially, the clarity of their interface, combined with robust risk management tools like automatic Stop-Loss orders and the immediate visibility of liquidation prices, makes exploring amplified trading opportunities genuinely feasible and less intimidating. It’s about empowering traders, not just by providing tools, but by enabling a safer, more informed approach to the exciting world of derivatives trading.

Beyond Leverage Mechanics: Bitunix’s Comprehensive Features

While our focus has been on Bitunix’s excellence in simplifying how crypto futures leverage works, it’s important to recognize that its value extends far beyond just amplified trading. Bitunix offers a comprehensive and robust trading positions ecosystem designed to cater to a wide range of crypto enthusiasts.

Key aspects of Bitunix’s full trading ecosystem include:

- Low Trading Fees: A significant advantage for anyone engaging in frequent trading, especially with leverage, is Bitunix’s highly competitive futures fees. Makers pay just 0.02% and takers 0.06%. These low rates mean that more of your trading capital remains in your pocket, which is crucial when managing how crypto futures leverage works with amplified positions, as even small fees can add up with high-frequency trades.

- Diverse Trading Pairs: With over 700+ diverse trading pairs available, Bitunix offers ample opportunities for both spot and leveraged positions across a wide array of cryptocurrencies, allowing you to diversify your strategies in the futures market.

- 24/7 Multilingual Customer Support: When dealing with complex leveraged positions, swift and reliable assistance is critical. Bitunix ensures that help is always just a click away, providing peace of mind.

- Reliable Performance: The platform is engineered for stability and speed, ensuring your critical trades are executed smoothly without technical glitches, which is vital in volatile markets.

If you’re already familiar with the basics, delve deeper into our previous discussion on High Leverage Crypto Futures.

Master Your Trades: The Bitunix Verdict on How Crypto Futures Leverage Works

For individuals seeking to confidently enter the dynamic world of crypto futures, understanding how crypto futures leverage works is fundamental. Bitunix stands out as a premier platform that not only provides access to significant leverage (up to 125x) but also masterfully blends this power with an intuitive user interface and a suite of essential risk management tools. This combination ensures that even newcomers can explore amplified trading opportunities responsibly and with greater peace of mind.

Bitunix doesn’t just offer advanced features; it makes them accessible and understandable, guiding users through the intricacies of leveraged trading with clarity and support. Coupled with its competitive low fees and a comprehensive derivatives trading ecosystem, Bitunix provides a powerful yet genuinely user-friendly environment for both aspiring and experienced leveraged traders.

Frequently Asked Questions

- What is margin in crypto futures leverage? Margin is your own capital used as collateral when taking a leveraged position, acting as a security deposit for the borrowed funds.

- How does liquidation happen when how crypto futures leverage works? Liquidation occurs when your losses on a leveraged position deplete your margin below a certain threshold, leading the exchange to automatically close your trade to prevent further debt.

- Can I lose more than my initial margin when how crypto futures leverage works? While exchanges typically aim to liquidate you before your balance goes negative, in extremely volatile markets or with sudden price gaps, it is technically possible to lose more than your initial margin, though many platforms have mechanisms (like insurance funds) to mitigate this.

- Does Bitunix teach me how crypto futures leverage works effectively? Bitunix’s platform is designed for clarity, with intuitive displays, tooltips, and readily accessible risk management tools that guide users in understanding and applying leverage effectively.

- Are fees higher when using how crypto futures leverage works on Bitunix? Bitunix’s trading fees (0.02% maker / 0.06% taker for futures) are applied per trade, not directly tied to the leverage amount itself. However, using higher leverage means opening larger position sizes, which can result in larger absolute fee amounts and a magnified impact on your overall profit/loss in high leverage crypto futures trading.

CryptoPulseHQ is a crypto-focused publication built by professional traders, for traders. With over 7 years of experience in the crypto space, our mission is to simplify exchanges, tools, and strategy — so you can trade smarter and stay one step ahead.

We publish daily guides, comparison blogs, and step-by-step tutorials to help you navigate the fast-moving world of crypto with clarity and confidence.

This guide was written by a cryptocurrency researcher with extensive experience in altcoin platforms, decentralized trading tools, and global exchange analysis. Our goal is to help users trade securely and responsibly through transparent education. — **Disclaimer:** This content is for informational purposes only and does not constitute financial, investment, or legal advice. Always review the laws in your country before using any cryptocurrency platform. Trading involves risk, and past performance is not a guarantee of future results. Some of the links on this site are affiliate links, which means we may earn a commission if you click through and make a purchase — at no additional cost to you.